BROADWIND (BWEN)·Q4 2025 Earnings Summary

Broadwind Posts $155-160M FY 2025, Guides to 20%+ Organic Growth in 2026

February 5, 2026 · by Fintool AI Agent

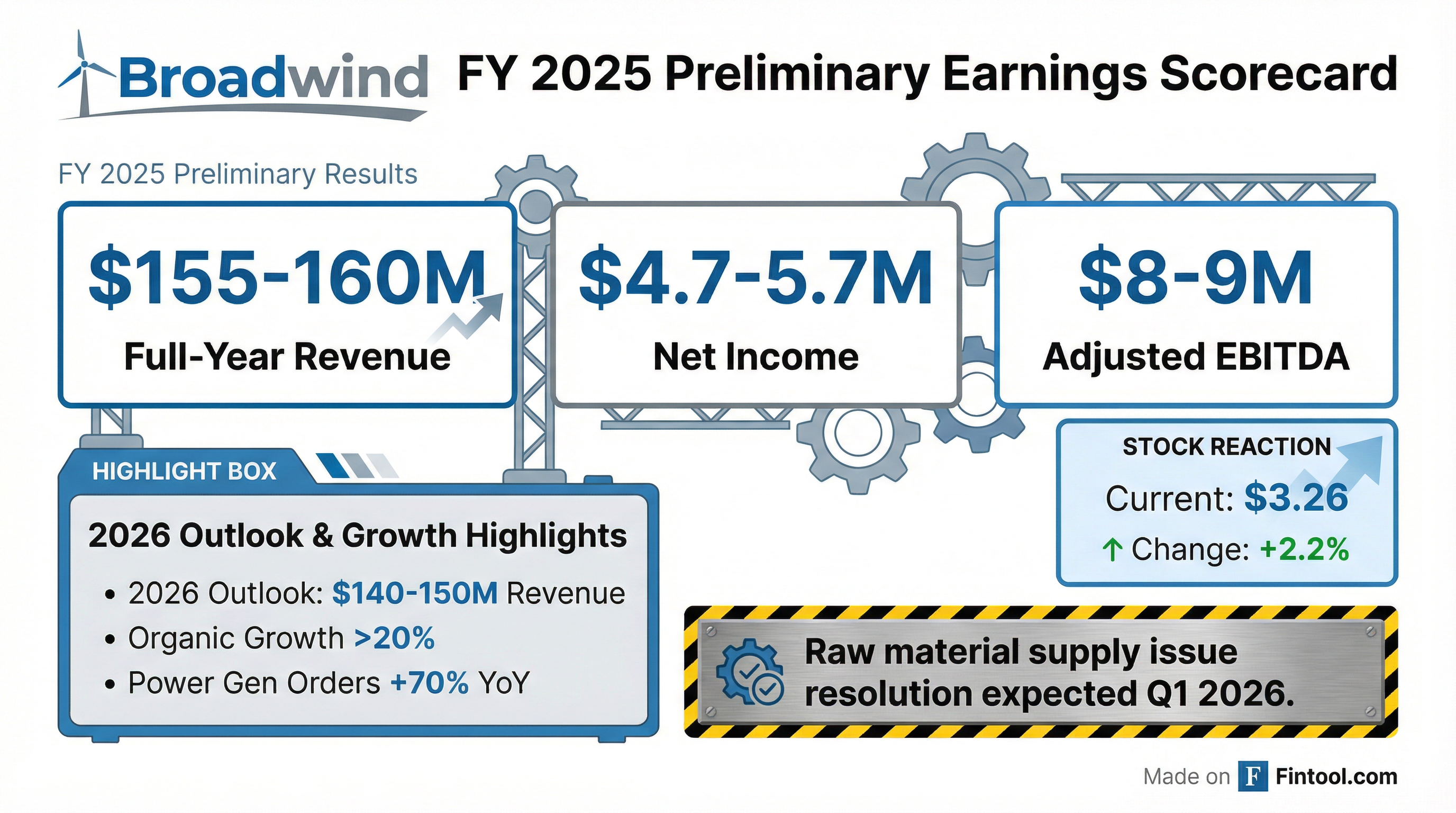

Broadwind (NASDAQ: BWEN) released preliminary FY 2025 results today, reporting full-year revenue of $155-160 million and net income of $4.7-5.7 million. The diversified precision manufacturer's results came in line with guidance provided in November 2025, supported by strong demand across power generation, industrial, and energy sectors.

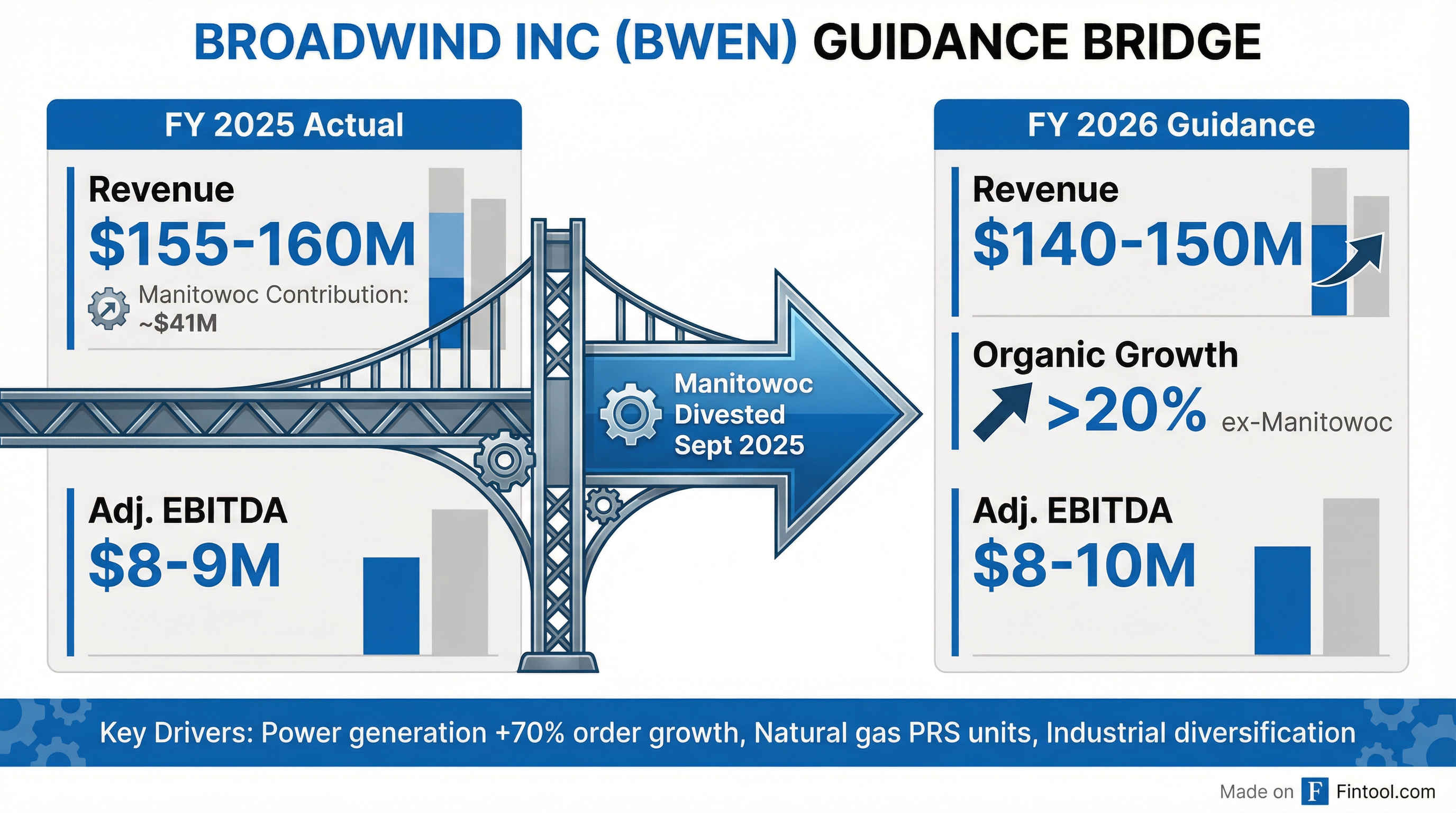

The company simultaneously introduced FY 2026 guidance calling for revenue of $140-150 million and Adjusted EBITDA of $8-10 million—numbers that look like a decline on the surface but actually represent organic growth exceeding 20% when excluding the divested Manitowoc operations.

Did Broadwind Meet Expectations?

Broadwind delivered on its prior guidance. The preliminary FY 2025 results show:

The company has limited sell-side analyst coverage, so beat/miss analysis against consensus is less meaningful here. What matters: management delivered on its November 2025 commitments despite a raw material supply disruption in Q4.

Q4 Headwinds: A raw material supply issue under the directed-buy program of an OEM customer in the Heavy Fabrications segment reduced manufacturing throughput and operating efficiency. Broadwind expects this to be resolved in Q1 2026.

What Did Management Guide?

This is the headline story. At first glance, the 2026 guidance looks like a revenue decline—but it's actually a growth story once you adjust for the Manitowoc divestiture.

FY 2026 Guidance:

The Manitowoc Math: Broadwind sold its Manitowoc, Wisconsin operations on September 8, 2025. That facility contributed approximately $41 million in revenue during 2025 (and ~$25 million in 2024).

Stripping out Manitowoc:

- FY 2025 continuing ops: ~$115-120M

- FY 2026 guidance midpoint: $145M

- Implied organic growth: ~20-25%

CEO Eric Blashford confirmed this framing: "At the midpoint of our newly introduced 2026 financial guidance, we're forecasting organic revenue growth of more than 20% this year, when compared to the full-year 2025, excluding financial contributions from our recently divested Manitowoc facility."

What's Driving the Growth?

Power Generation Orders +70% YoY: Order rates surged in the power generation vertical, up more than 70% year-over-year in FY 2025. This is the primary engine behind management's organic growth confidence.

The company serves three core verticals:

- Power Generation — Wind tower manufacturing, natural gas equipment

- Industrial — Precision gearing, heavy fabrications

- Energy — Components for oil & gas, renewables

Blashford noted "demand conditions across our core end-markets remain strong entering 2026," with particular strength in power generation.

How Did the Stock React?

BWEN shares traded at $3.26, up 2.2% on the day the preliminary results were released. Key stock metrics:

The stock has more than doubled from its 52-week low of $1.41, reflecting improved sentiment around the company's strategic repositioning and order momentum.

What Changed From Last Quarter?

Q3 2025 vs. FY 2025 Preliminary:

In Q3 2025, Broadwind reported quarterly revenue of $44.2 million, the strongest quarter of the year. The full-year preliminary figures imply Q4 2025 revenue of approximately $35-40 million—a sequential decline from Q3.

This softness was explicitly attributed to the Heavy Fabrications raw material issue. Management's tone suggests this is a one-time operational hiccup rather than a demand problem: "The Company has taken corrective action to address the supply issue and expects the impact to operations to be resolved during the first quarter of 2026."

Quarterly Revenue Trend:

Capital Allocation & Balance Sheet

Broadwind also announced Amendment No. 4 to its Credit Agreement with Wells Fargo. The key changes:

- Modified Fixed Charge Coverage Ratio requirements through 2026

- Lowered the required ratio from 1.1:1.0 to 0.75:1.0 for the period through December 2026

- Excluded certain capital expenditures from Unfinanced CapEx calculations

This provides additional financial flexibility as the company invests in growth initiatives. Blashford stated: "We enter 2026 with significant balance sheet optionality to support long-term value creation for our shareholders."

2026 Capital Priorities:

- New product innovation

- Accretive inorganic growth (M&A)

- Opportunistic share repurchases

Forward Catalysts

Near-term (Q1 2026):

- Full Q4 2025 results release: March 11, 2026

- Resolution of Heavy Fabrications supply issue

- Earnings call for Q&A on segment details

Full-year 2026:

- Power generation order conversion into revenue

- Potential acquisition activity ("accretive inorganic growth")

- Share repurchases under existing authorization

Key Risks to Monitor

-

Customer Concentration: Broadwind historically derives significant revenue from a few large OEM customers, creating concentration risk.

-

Wind Energy Policy: Federal tax incentives and renewable portfolio standards materially impact demand for wind tower manufacturing.

-

Tariff Exposure: Trade policy changes affecting steel imports or other materials could impact costs and competitiveness.

-

Supply Chain Disruptions: The Q4 2025 raw material issue demonstrates ongoing supply chain vulnerability.

The Bottom Line

Broadwind's FY 2025 prelim results confirm execution on prior guidance despite operational headwinds. The real story is the 2026 setup: 20%+ organic growth driven by surging power generation orders, with EBITDA margins holding steady at the high end of the range.

For a $76 million market cap company, the combination of strong order momentum, strategic portfolio optimization (Manitowoc sale), and balance sheet flexibility creates an interesting setup—though investors should weigh customer concentration and policy risks.

Full Q4 2025 results and the earnings call are scheduled for March 11, 2026.